Raise your prices – your customers won't leave you (8 min read)

Raising prices is one of the most powerful and underused strategies in B2B. Still, many business leaders hesitate. They fear backlash, churn, or long negotiations. But when done right, price increases don't scare away customers – they build stronger businesses.

This is the first article in our series Pricing Insights, where we explore strategic, value-driven pricing as a growth engine.

The fear is emotional – the logic is financial

The fear of losing a customer often outweighs the data. Studies consistently show that well-communicated, fair price increases rarely lead to mass churn. Why? Because customers don't buy on price alone. They buy based on value, trust, reliability, and switching costs.

If your product or service is integral to your customer's operations, a 3–5% price change is far less important than service levels, quality, or the cost of finding a new provider. Yet many companies avoid price adjustments year after year, losing millions in unrealized margin.

Your customers expect it

Inflation, wage growth, and supplier price hikes have become everyday topics. Everyone's costs are increasing. So when your pricing stands still, it creates tension: either you're absorbing costs (hurting your margin), or you're signaling that you have plenty of slack.

In reality, customers expect price reviews. Many even build annual budget adjustments based on standard indexation. The absence of such a signal may weaken your positioning over time.

What happens when you raise prices?

Here’s what typically happens when companies apply well-managed price increases:

• 80–95% of customers accept it without escalation.

• A few ask for clarification or renegotiation.

• A tiny minority may push back – but often still stay.

If you accompany the price change with clear value communication (“here’s what we’ve improved”), timing (aligned with contract cycles), and internal alignment (your sales and support teams know how to explain it), then price increases land with credibility.

The science behind it

The behavioral economics work of Nobel laureate Daniel Kahneman shows that people fear losses more than they appreciate gains – a principle known as loss aversion. This often explains why sales teams fear price increases more than they need to. In reality, well-managed increases rarely lead to churn. McKinsey has pointed out in multiple studies that price increases are the most effective lever for profit improvement, yet they remain underused. Harvard Business Review has also emphasized how well-justified price adjustments, when communicated clearly, can actually enhance customer trust and company valuation.

The business case is overwhelming

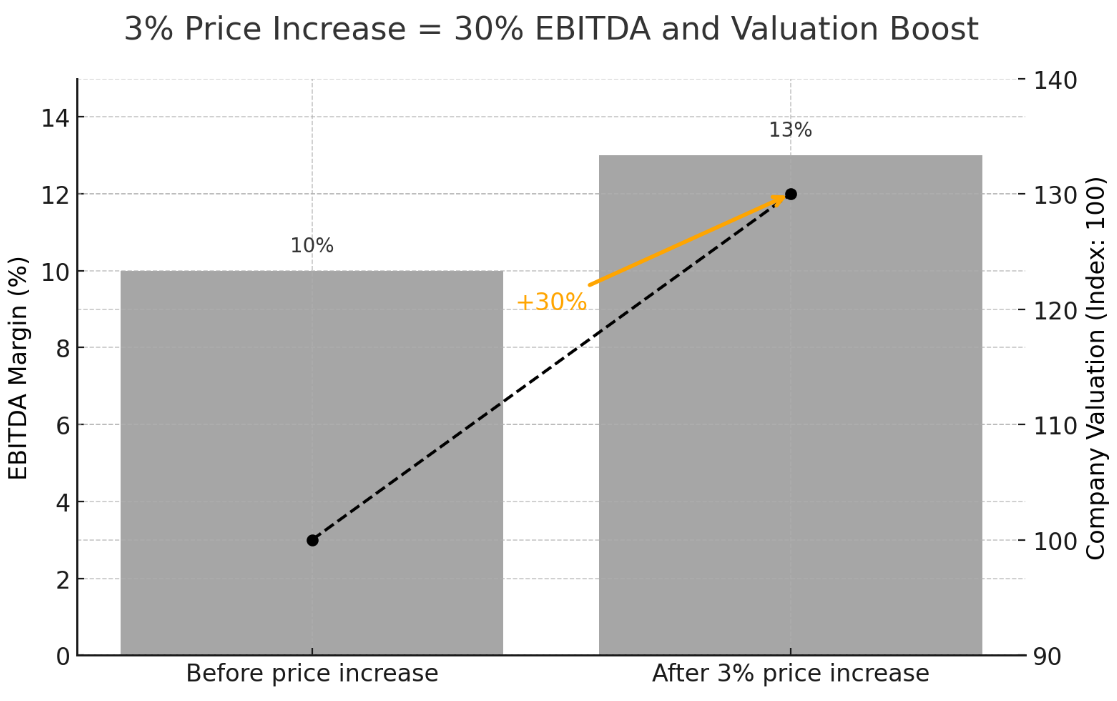

A 3% price increase on your current business, with no volume loss, flows directly to the bottom line. If your company has a 10% EBITDA margin, it becomes 13%. That is a 30% profit increase. In contrast, to achieve the same effect through growth alone, you would need to increase sales by 30%.

In a business valued at 10x EBITDA, this 3% price adjustment can lead to a 30% increase in enterprise value. That’s the power of pricing leverage.

For companies with hundreds or thousands of customers, the effect is exponential. More margin = more reinvestment capacity = stronger future offering = better customer experience = higher resilience.

No one loses when you raise prices responsibly

• Customers want a long-term, financially healthy partner who invests in innovation and service.

• Sales teams benefit from hitting revenue targets more easily, without needing to close as many low-margin deals.

• The organization strengthens its brand and perceived value.

• Owners and investors see real improvement in earnings and valuation.

Others are doing it too

Across industries, companies are adjusting their pricing to reflect higher costs, increased value, and stronger positioning. For example, software companies like Salesforce and Microsoft have raised enterprise pricing by 15–25% in recent years, citing ongoing product improvements and inflationary pressures. Cloud infrastructure providers such as Amazon Web Services and Google Cloud have introduced targeted price increases for high-usage customers and specific services. Even in industrial B2B, companies like Schneider Electric and Siemens have implemented consistent annual price adjustments tied to input costs and value creation.

If you hesitate while others raise, you risk:

• Looking uncertain or desperate

• Training customers to expect flat pricing indefinitely

• Undermining your ability to reinvest and grow

The market moves forward. Your pricing needs to move with it.

How to raise prices effectively

Start with segments where you know the value you provide is strong and the pricing has lagged. Focus on:

• Customers on outdated price plans

• Accounts with low price consistency within the same tier

• Contracts missing indexation clauses

Develop internal price increase playbooks. Train account managers on value communication. Send pre-notices. Give customers context. And when applicable, pair the price increase with a benefit: better reporting, new support features, extended service hours.

Case from the field

A managed IT services company with 1,200 clients rolled out a 4% price increase across 60% of its base. Their approach:

• Segmented clients based on support intensity and contract age

• Created templated communication explaining the increase

• Trained the entire sales and support staff

Result: less than 2% of customers pushed back. Churn stayed flat. EBITDA margin grew from 11.8% to 14.5% over 12 months.

Why it works better than other methods

Price increases (when based on value and not volume) outperform many other profit levers:

• Hiring fewer people? Risks capacity, service quality, and morale.

• Cutting supplier costs? Often has a limit and can backfire.

• Growing sales? Always valuable – but more expensive and harder to execute than pricing refinement.

Final word: raise with purpose

You don’t need a grand pricing overhaul to get started. Pick a segment. Focus on harmonization. Identify outliers and test increases. Track results and iterate. But most importantly: start.

This is not about charging more for the sake of it. It’s about charging what your product or service is worth – and building a company that can invest, scale, and thrive.

Author: "Mr Pricing", Tobias Murray, CEO and Co-founder at VAERG ( Vaerg.com )

About the author. Tobias Murray helps B2B companies turn pricing into a scalable growth engine. With long-standing experience across industries, he specializes in structured, data-driven pricing strategies that consistently deliver 10–25% EBITDA uplift. As CEO of VAERG, he and his team transform fragmented pricing into a systematic, value-generating discipline.